The online broker for

active investors

Access a wide range of tools and trading opportunities to design, implement and execute your personal investment strategy.

Trusted by #65.000 dedicated investors

A message from our CEO

“Investors value a wide range of trading possibilities, a solid platform, great service, and transparent costs. That’s what LYNX brings together.“

A World of Opportunities

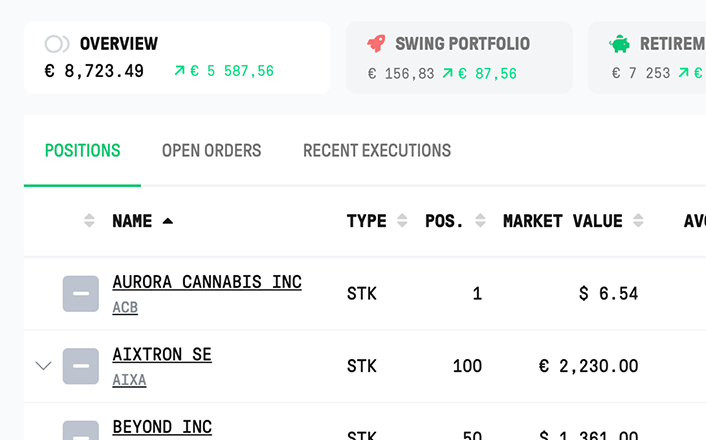

Strengthen and diversify your portfolio according to your personal preferences and insights with:

- Access to over 30 markets across more than 100 countries

- Holding and depositing in more than 20 currencies

- U.S. stock options

Whether you’re just starting out or a seasoned trader, LYNX provides a wide selection of investment products tailored to your needs. Before trading, be sure to carefully assess your experience, knowledge, and financial goals—so your strategy reflects what matters most to you.

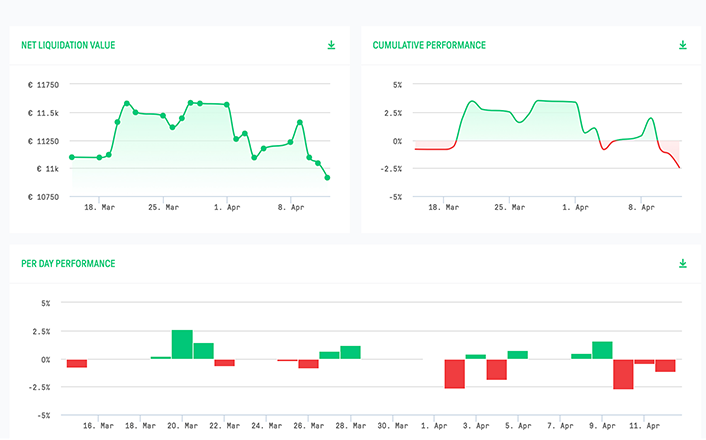

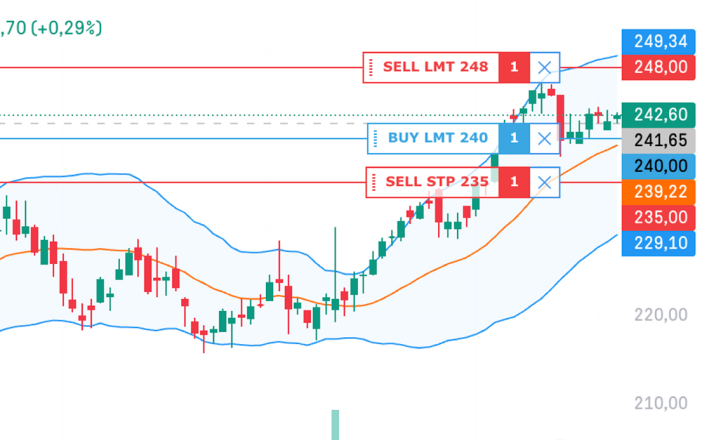

More Control – Even in Unpredictable Markets

Smart solutions powered by LYNX.

Trade outside regular market hours

Stop-loss and trailing stop orders available for all instruments

Protect your existing shares by purchasing put options

Real-time access to your portfolio and global markets from your mobile device

Smart solutions for better portfolio control—though risk remains part of the investment journey.

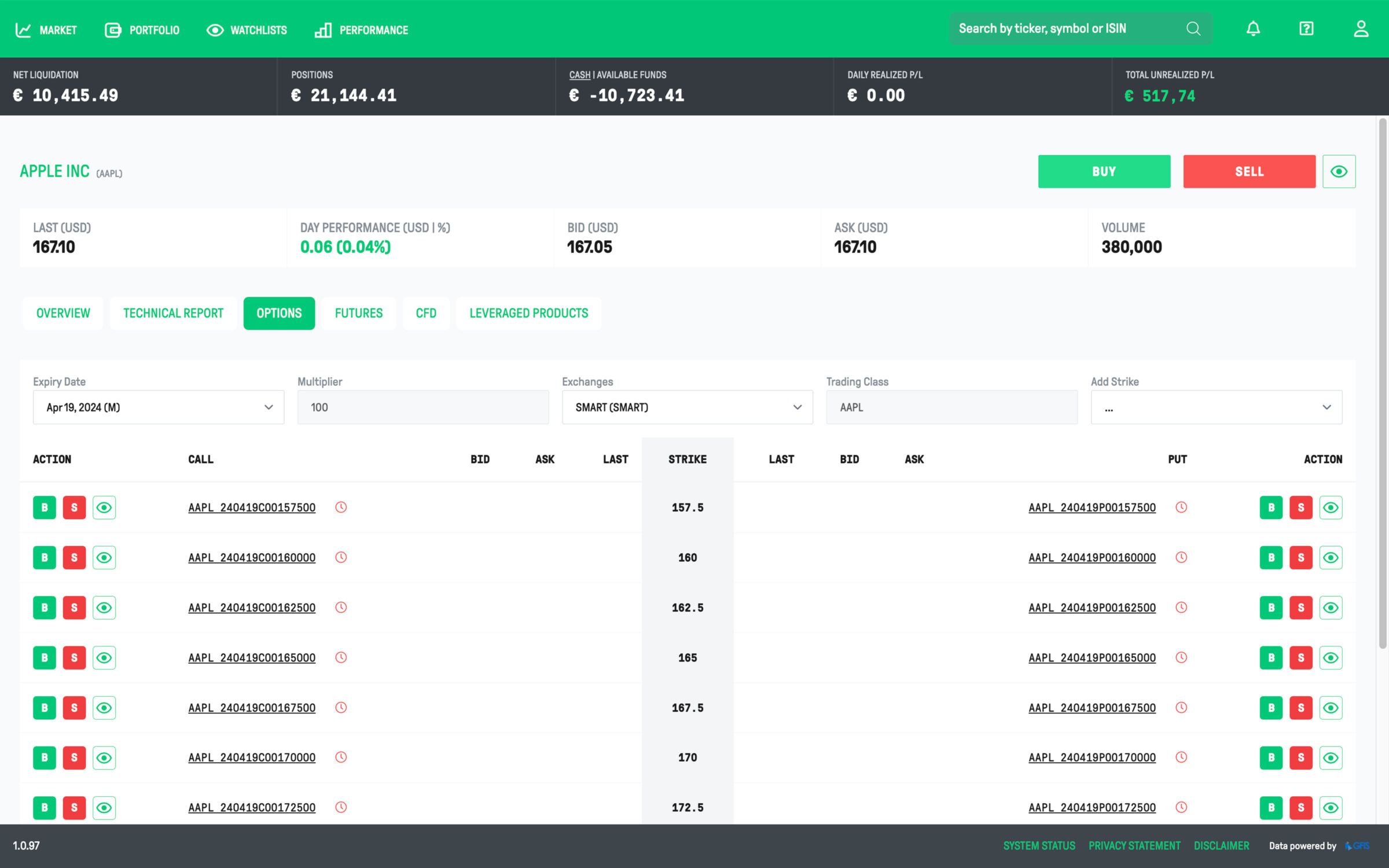

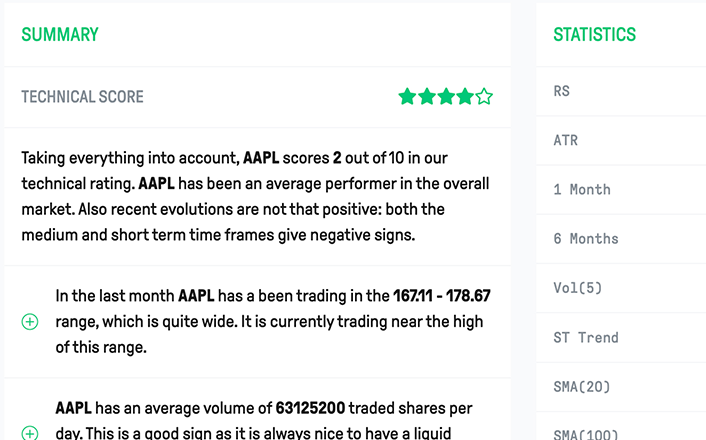

LYNX+ The platform designed for informed investors who expect more.

A professional and user-friendly environment—accessible via your PC, tablet, and smartphone. Now featuring TradingView charts.

Please note that these tools can help manage risks but cannot eliminate them. Make sure you fully understand what you’re doing.

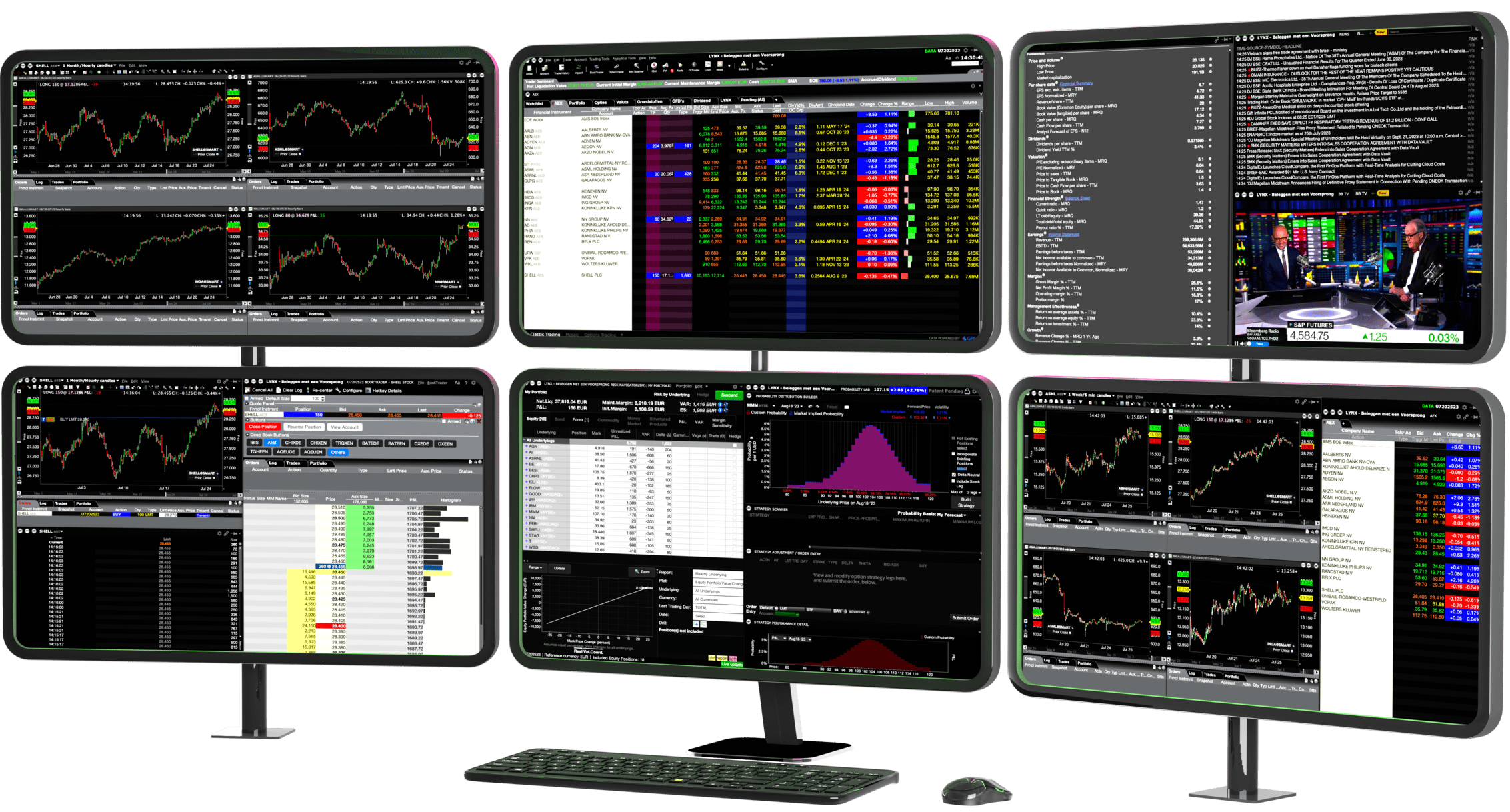

LYNX for professionals

Discover TWS, the award-winning trading platform engineered for advanced performance. Transform your desktop into a sophisticated, multi-screen trading environment inspired by Wall Street.

Professional Tools – Practical Insights

Service Support

Our team is selected for product expertise and operational reliability—ready to assist with platform-related questions.

Knowledge Hub

Access a structured library of educational materials, suitable for every experience level.

Market Updates

Subscribe to receive regular insights on platform innovations and market developments.

Start Investing with LYNX

LYNX is your all-in-one online broker—providing access to essential tools and products to support your trading strategy.

The Risks of Investing

Investing in financial instruments involves risks. Market prices may fluctuate, and depending on the product, this can result in the loss of your initial investment—or more in specific cases. It is important to only invest funds that are not needed for immediate expenses.

At LYNX, we believe informed investing is essential. It is important to reflect on your personal circumstances, investment objectives, and the characteristics of the products you intend to invest in.

Market risk

Market risk refers to potential losses caused by economic developments. For instance, slowing growth can reduce a company’s value, impacting its shares. A diversified portfolio may help limit this risk.

Price risk

Price risk refers to the potential impact of changing investment prices. Since markets constantly move, this risk is always present. Proper diversification can help reduce its effect.

Interest rate risk

Interest rate risk refers to the possible decline in investment value due to rising market rates. Higher rates can reduce consumer spending and increase corporate borrowing costs, which may pressure company profits—and affect shares, bonds, and related investment funds.

Credit risk

Credit risk refers to the possibility that an issuer—such as a company or government—fails to meet its financial obligations. Defaults or missed payments may lead to a significant loss in investment value.

Liquidity risk

Liquidity risk refers to the possibility that investments cannot—or can barely—be traded on an exchange. As a result, you may be unable to close positions when desired or may have to accept unfavorable pricing.

Currency risk

Currency risk occurs when investing in assets denominated in a currency other than the euro. If the exchange rate of that currency weakens against the euro, it may reduce the value of those investments.

Inflation risk

Inflation risk refers to the possibility that rising prices reduce the real return on investments. As purchasing power declines, the actual value of returns may fall below their nominal amount.