Bracket Order

The strategic one

A Bracket Order is a comprehensive type of order that allows investors to limit their loss and lock in a profit by “bracketing” an order with two opposite-side orders.

Learn more about this order type.

What is a Bracket Order?

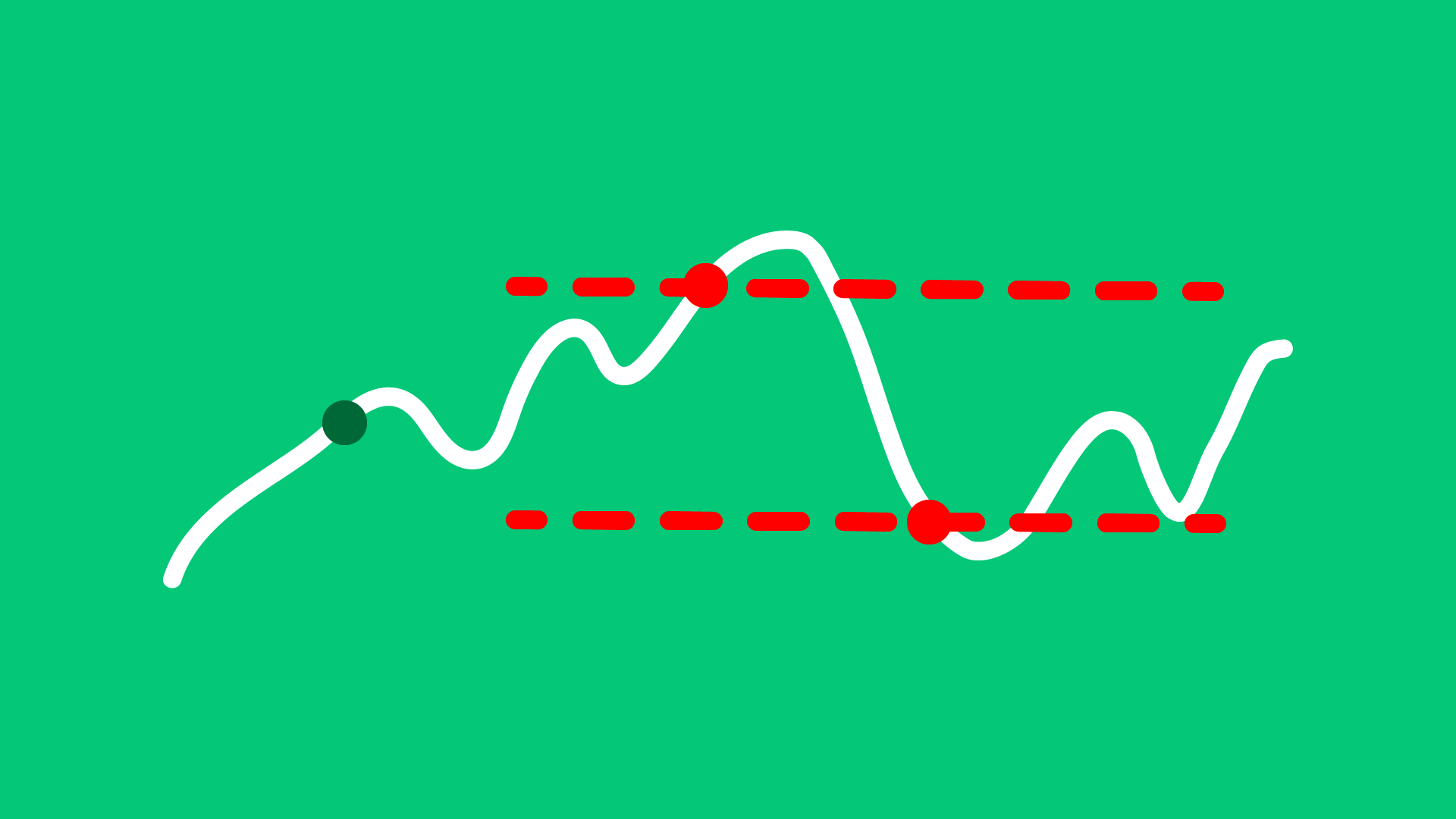

A Bracket Order consists of three components: a primary order (either buy or sell), a take-profit order, and a stop-loss order. The primary order executes first, while the other two orders are automatically placed in the market to secure profits or limit losses after the primary order executed.

Key Features

Three Orders in One

- By combining a primary order with a take-profit and stop-loss order, traders can define their entry and exit points, facilitating a more structured trading approach

- Once the primary order is executed, the take-profit and stop-loss orders automatically handle the rest, allowing traders to step away from the market without needing constant monitoring.

Predefined Exit Points

- Setting predefined exit points can help reduce the need for frequent market checks, as the orders will execute automatically at the desired levels, leading to less reactive trading.

- Knowing that exits are pre-planned gives traders more confidence in their trades, allowing them to follow through on their strategy without second-guessing during volatile market conditions.

How does it work?

When placing a bracket order, you’ll need to specify three key components: the primary order, a take-profit order, and a stop-loss order.

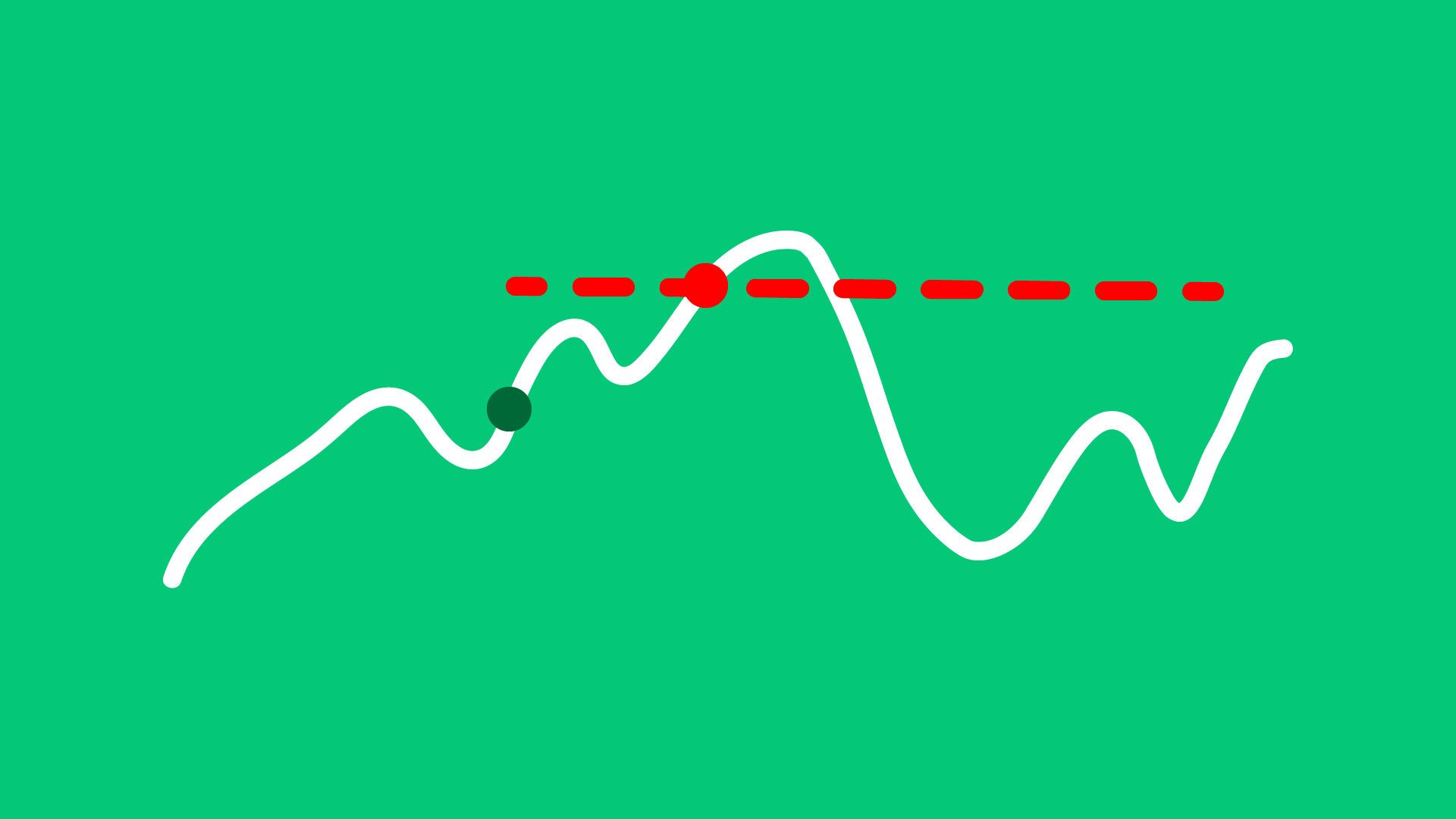

Buy Order

A buy order is accompanied by two sell orders:

- The take-profit is a sell limit order placed above the buy price, where you aim to sell the shares for a profit if the price rises.

- The stop-loss is a sell stop order placed below the buy price, to sell the shares if the price drops, minimizing your loss.

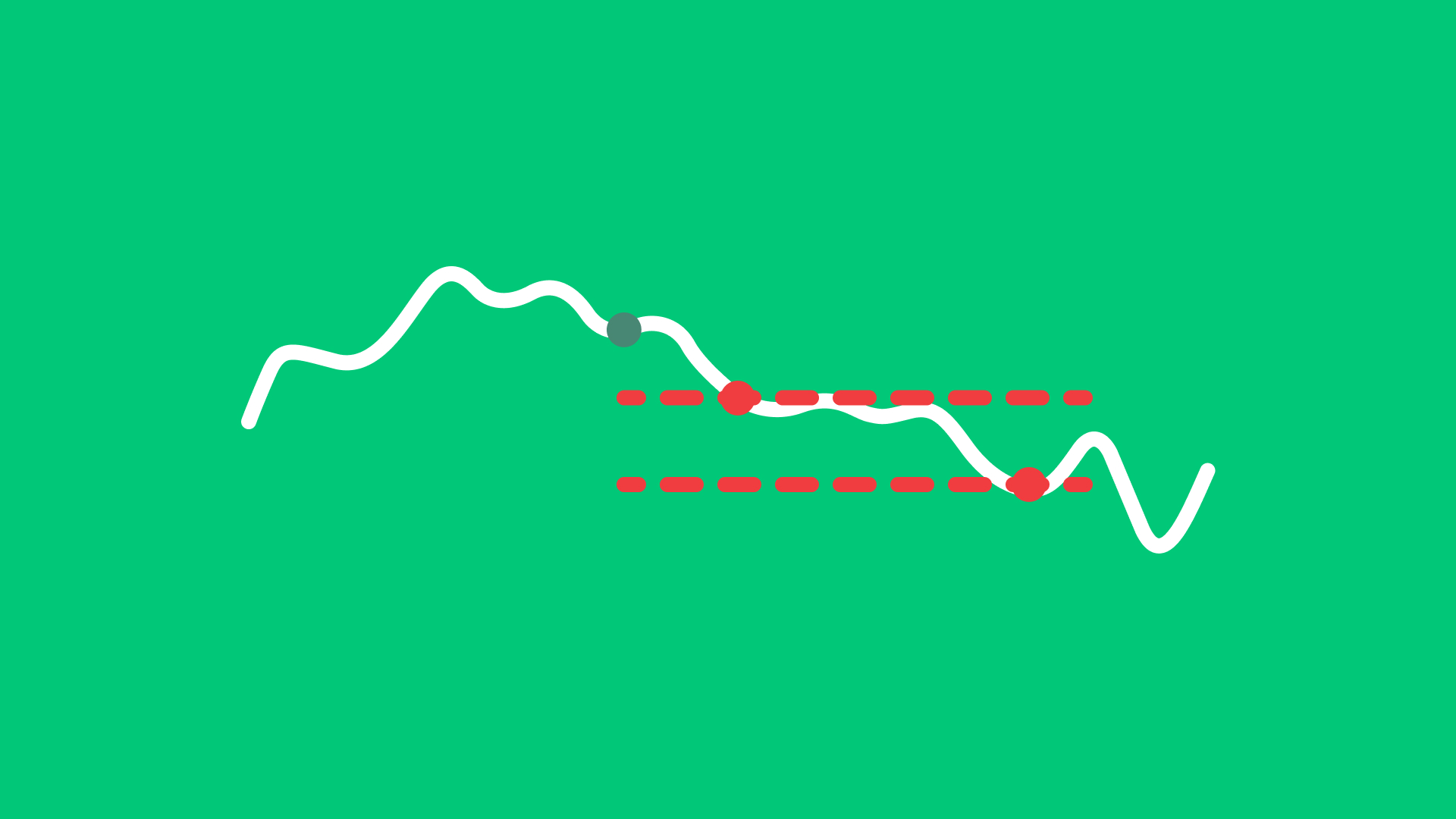

Sell Order

A sell order is accompanied by two buy orders:

- The take-profit is a buy stop order placed below the sell price, to buy back shares at a lower price and lock in profit if the price drops.

- The stop-loss is a buy limit order placed above the sell price, to buy back shares if the price rises unexpectedly, limiting further loss.

Example:

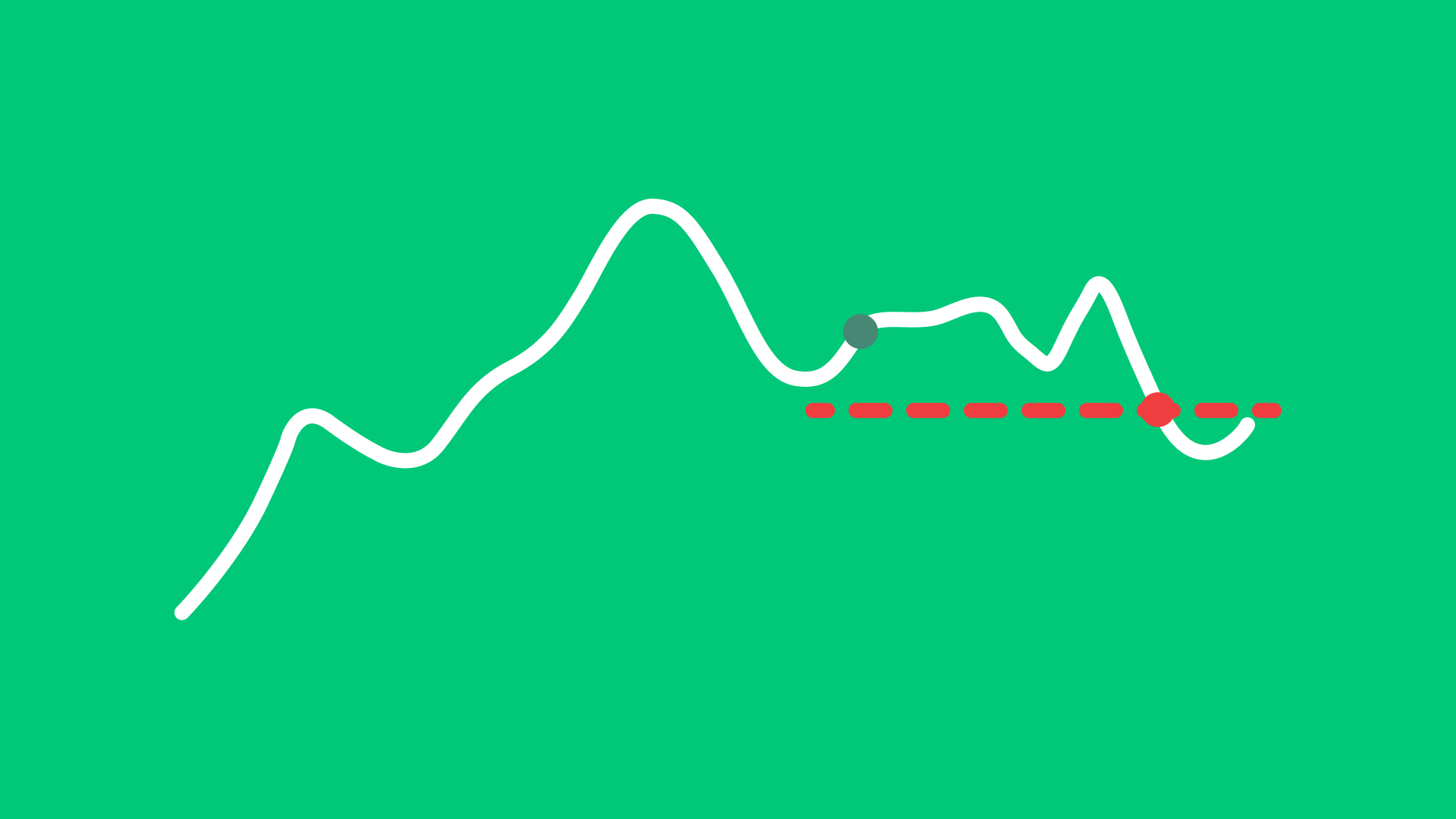

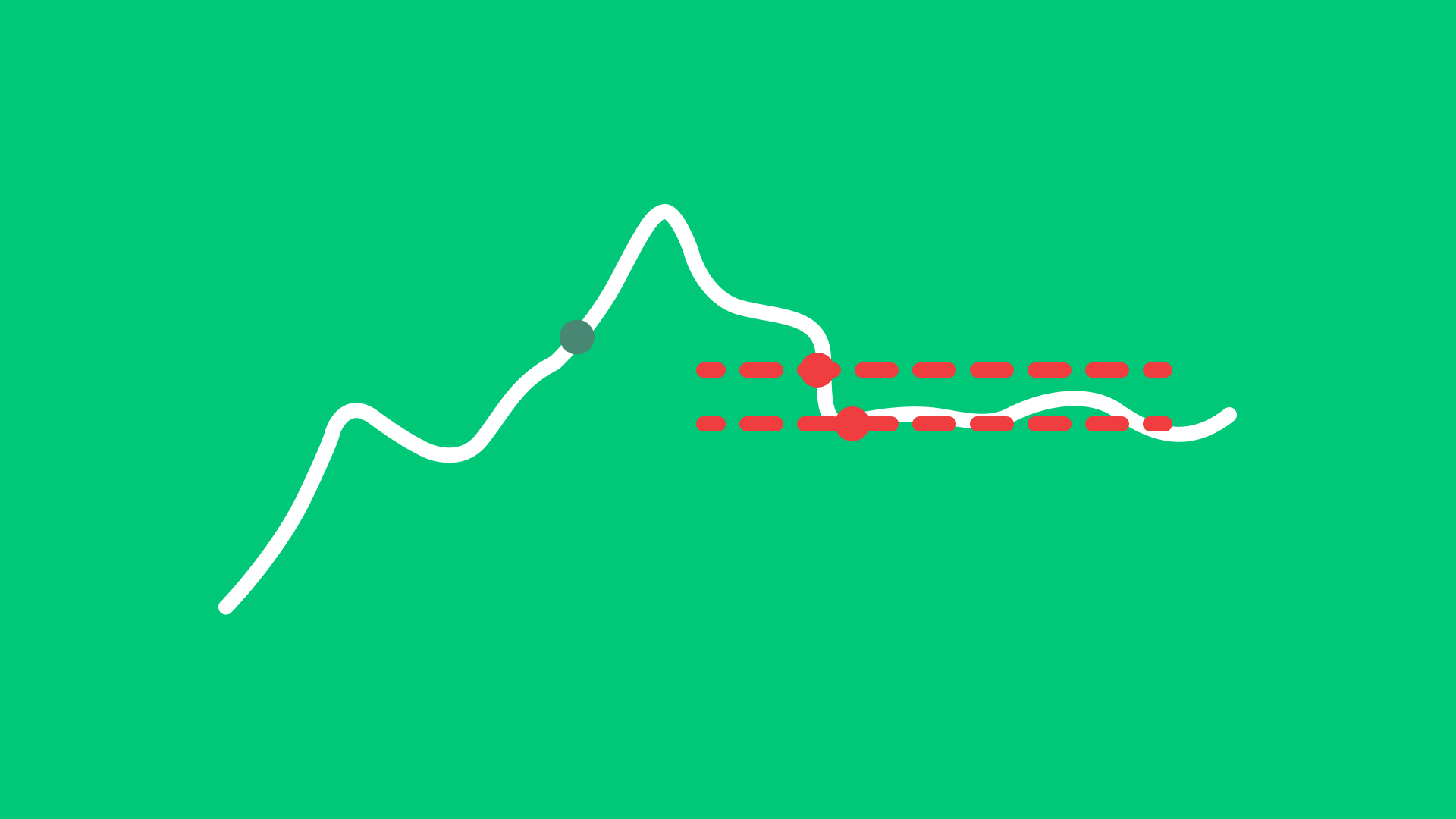

Imagine you wish to buy 100 shares of ABC for 220 EUR. However, at the same time you want to determine a stop loss order to sell the shares should the price drop to 215 EUR. You also wish to place a take profit order in case that ABC rises to 230 EUR during the session.

In Scenario 1, the price of ABC rises to 230 EUR, which is the Limit Price of your attached Limit Sell order. The order fills at that price and you make profit.

In Scenario 2, the price of ABC drops to 215 EUR. Here, your stop-loss order is triggered. A sell order is executed at 215 EUR to minimize your losses.

In both scenarios the other not executed attached order will be canceled.

When using a bracket order, you are prioritizing both profit and risk management by setting predefined levels for taking profits and limiting losses. While this order type provides added control, it’s important to note that execution prices may vary due to market conditions, especially in volatile markets or for less liquid securities. Ensure that the set profit and stop-loss limits are appropriate for your investment strategy, as wide price swings or gaps can lead to unexpected results.

Advantages and disadvantages

Advantages

Disadvantages

- Risk Management:

A Bracket Order helps manage risk by automatically placing take-profit and stop-loss orders, ensuring you have predefined exit points.

- Complexity:

Setting up a Bracket Order may be more complex than a simple market or limit order, which can be challenging for beginners.

- Automated Execution:

The automated nature of Bracket Orders allows you to execute trades without having to monitor them constantly.

- Market Conditions:

In volatile markets, the execution of stop-loss orders may occur at prices worse than expected, leading to higher losses.

- Flexible Profit Targets:

You can set specific price levels for taking profits, allowing for more strategic trading.

- Partial Fills:

Depending on the chosen order types, if there is insufficient liquidity, the stop-loss orders may be partially filled at different prices.

How to attach a Bracket Order to a primary order in LYNX

Login to LYNX+ and search the product you would like to Buy or Sell by ISIN, Name or Ticker.

Select the Buy or Sell button in the top-right corner, the order ticket will open on the right side. Here you can define your primary order and to attach a Bracket Order you can decide to add them via the + Optional Order Attachments icon.

After defining your Profit Taker and Stop Loss, you can review the order details in the Summary.

To proceed, click Send Order to submit or Cancel to discard the order.

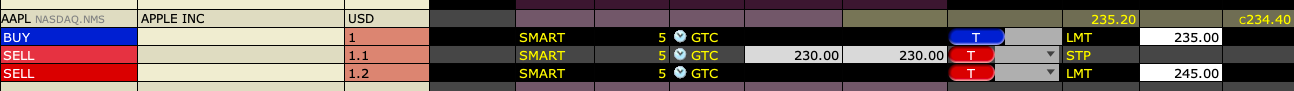

Login to the TWS and open your watchlist.

Create an orderrow by right-click the ticker and select Buy or Sell. After defining this primary order right-click the orderrow and select Attach > Bracket Order.

You can now define the Profit Taker and the Stop Loss by adjusting the limit and the stop prices.

Once done, click on Preview. You can review your order details. To confirm, click on Override and Transmit.

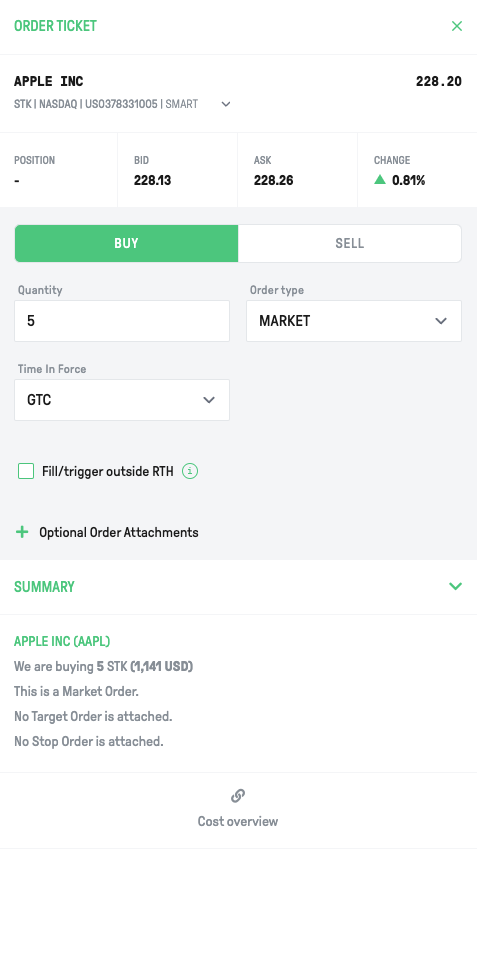

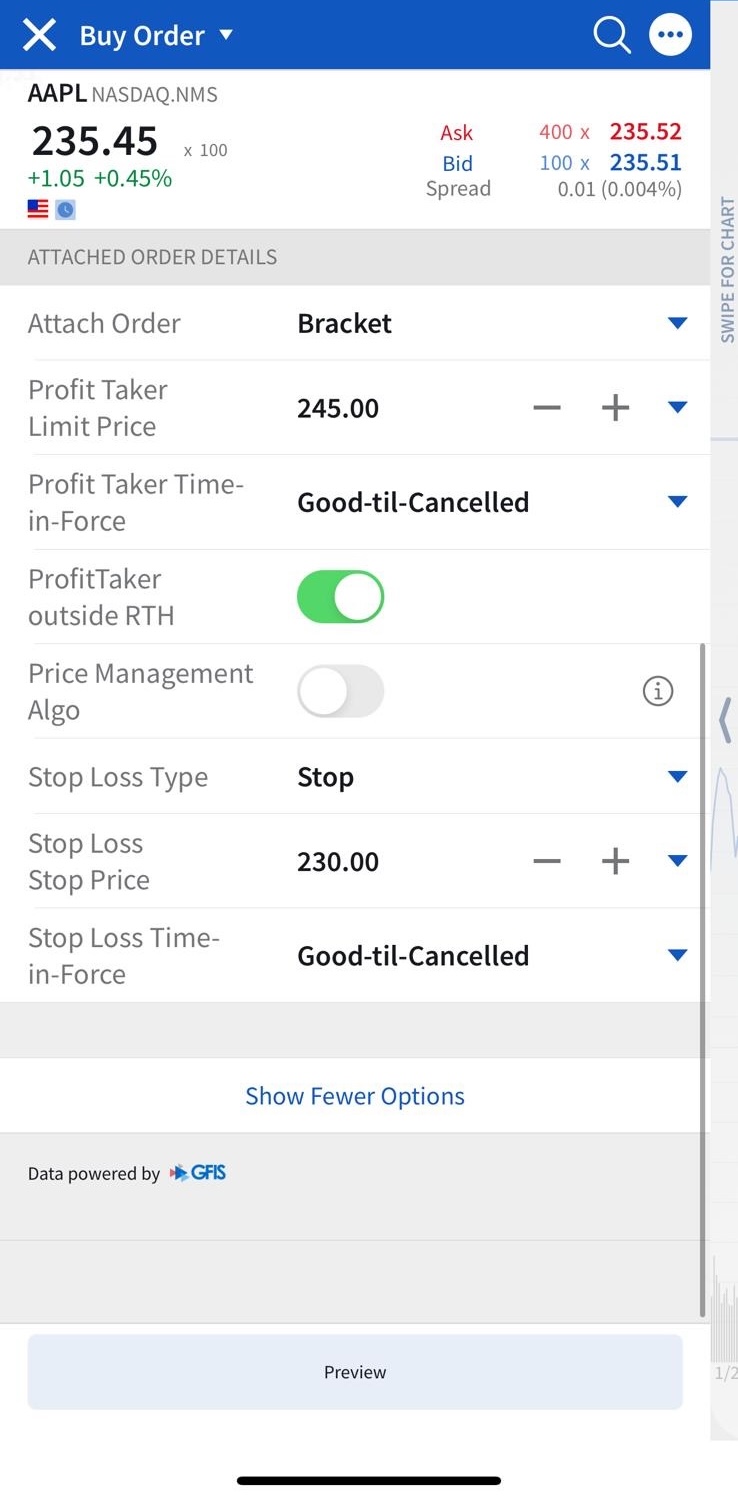

In the app, search the product you wish to Buy or Sell. After clicking on one of these the orderticket will open.

As shown on the media, open the Attach Order part and choose Bracket Order. You can now define the Primary Order, the Profit Taker and the Stop Loss by adjusting the limit and the stop prices.

Once done, click on Preview. You can review your order details.

To submit the order, swipe right over the Slide To Submit button.

Tips before submitting a Bracket Order

When submitting a bracket order, it’s essential to consider several key points to ensure you achieve the best possible execution and minimize potential issues.

Appropriate Ordertype

Decide whether to use market or limit orders for your primary order.

Using a limit order can help you control the entry price, while a market order prioritizes immediate execution.

Adjust for Timeframes

Consider the time frame of your trade.

For short-term trades, tighter stop-loss and take-profit levels may be necessary, while longer-term trades might allow for wider margins based on market fluctuations.

Test in Paper Trading

If you’re new to Bracket Orders, practice with a paper trading account first.

This allows you to become familiar with how they work without risking real capital.

FAQ

A bracket order typically includes a market order or limit order for the initial entry, a limit order for taking profit, and a stop-loss order to minimize potential losses.

Yes, you can use bracket orders for both long (buy) and short (sell) positions. The mechanism remains the same, with a profit target and stop-loss in both cases.

A bracket order is ideal when you want to set predefined exit points for both profit-taking and loss-limiting, especially in volatile markets where prices can fluctuate rapidly.

When placing a bracket order, you can specify the profit target as a fixed price above the entry price and the stop-loss level below the entry price.

Right-click on the position you want to create a bracket order for. Select Trade and Create Target/Stop Exit Bracket.

You can now define the Profit Taker and the Stop Loss by adjusting the limit and the stop prices.

Once done, click on Preview. You can review your order details. To confirm, click on Override and Transmit.

Login to LYNX+ and click on Portfolio in the top left corner.

Go to Positions and click on the three dots on the right side of the position you would like to submit a bracket order for and select Attach Order. Under Optional Order Attachments, you can enter a Stop Loss and attach a Profit Target.

After customizing the order ticket to your preferences, you can review the order details in the Summary.

To proceed, click Send Order to submit or Cancel to discard the order.

Login to the LYNX Trading app and navigate to your Portfolio. Select the position you would like to attach a Bracket Order to.

At the bottom you will see a small pop-up summary about your position. Select the button Exit Strategy and define your Profit Taker and Stop Loss.

Once done, click on Preview. You can review your order details. To submit the order, swipe right over the Slide To Submit button.