EMIR & LEI Information

According to the regulations of MiFID II and MiFIR, which entered into force on 3 January 2018, we are required to report our clients’ transactions to the competent supervisory authority. As part of this reporting obligation, corporate clients must be identified using a Legal Entity Identifier (LEI). Without a valid LEI, our execution partner Interactive Brokers (IB) is no longer permitted to carry out reportable securities transactions on behalf of LYNX’s corporate clients.

Below you will find answers to frequently asked questions about the Legal Entity Identifier.

What is a Legal Entity Identifier (LEI)

The Legal Entity Identifier (LEI) is a 20-character alphanumeric code used to uniquely identify entities participating in financial markets. The LEI system was introduced in response to the 2008 financial crisis to improve transparency and enhance market oversight. Under current regulations, transactions must be reported to the relevant supervisory authority and can be clearly linked to the reporting entity through its LEI. Without a valid LEI, Interactive Brokers (IB) is not permitted to execute reportable securities transactions on your behalf.

Cleared clients may delegate their EMIR trade reporting obligations to Interactive Brokers. IB also offers support in obtaining a Legal Entity Identifier for clients who are subject to the LEI requirement but do not yet have one.

Accessing your EMIR & LEI Information

- Log in into your Client Portal

- In the menu at the top right corner, select Welcome and then Settings. Within the column Account Configuration, select EMIR & LEI Information.

- Select one of the options below and click Continue:

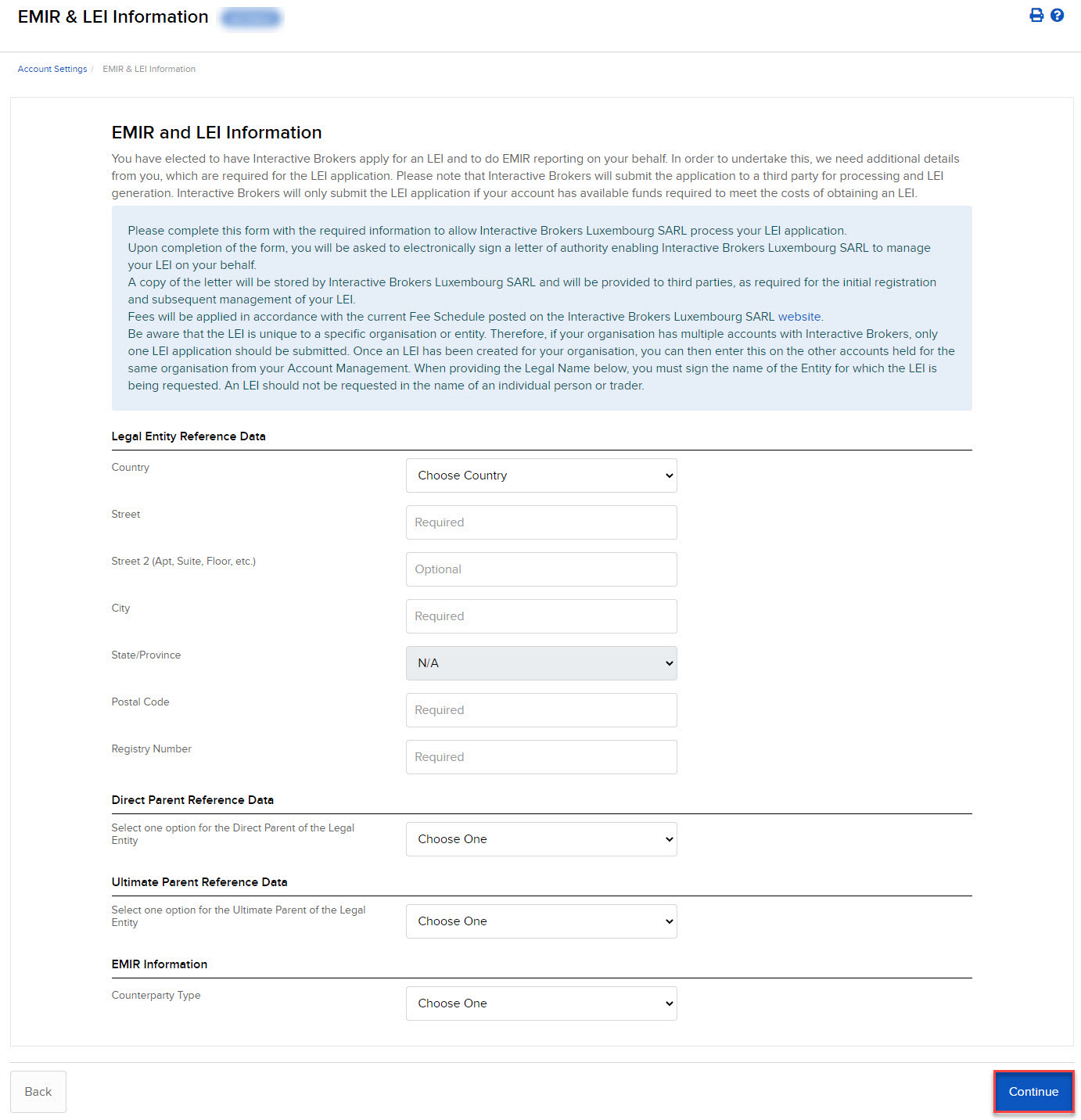

I do not have a LEI but would like IBKR to apply for a LEI and handle EMIR reporting on my behalf

- Enter the required Legal Entity Reference Data and click Continue.

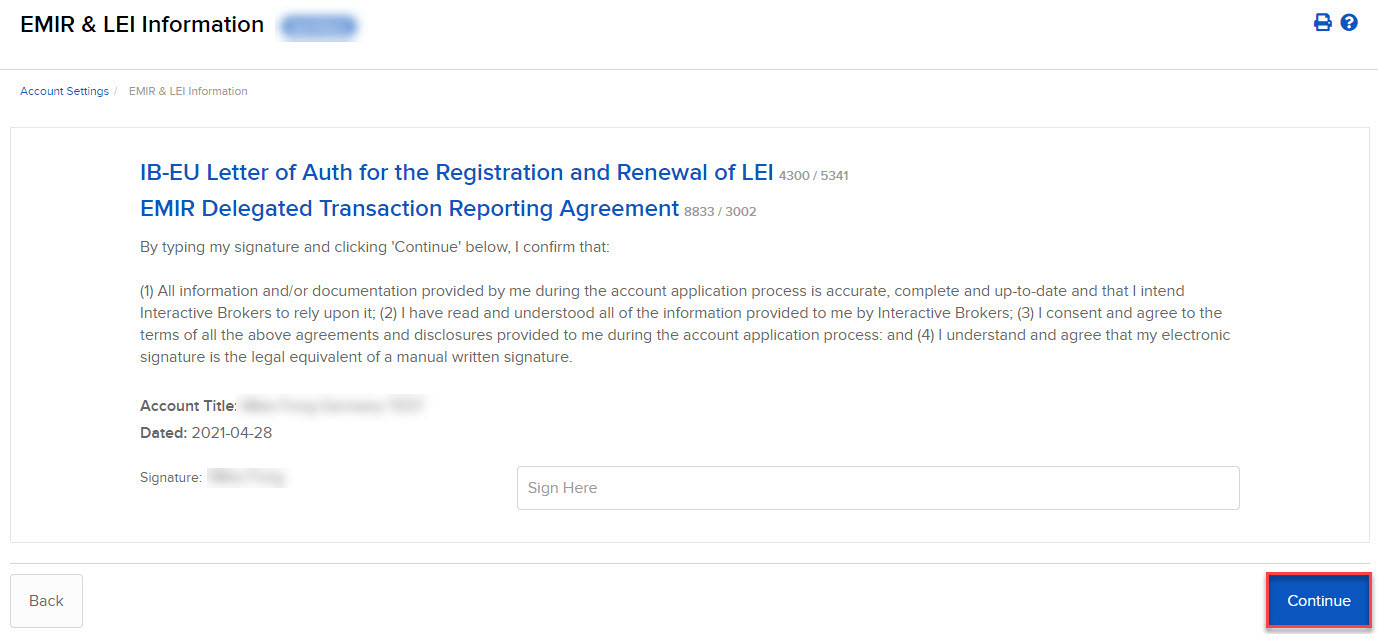

- Once the Legal Entity Reference Data has been completed, sign the Letter of Authorization by typing your name and clicking Continue.

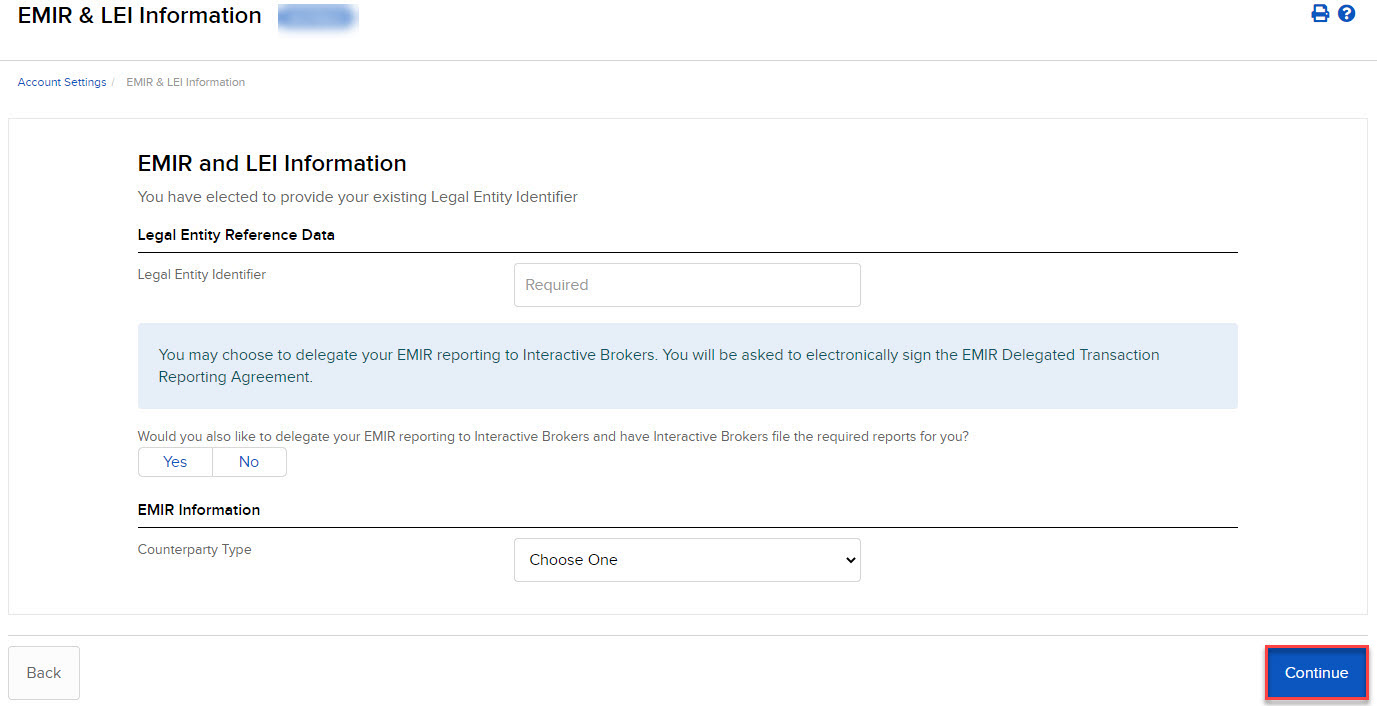

I have already obtained a LEI and wish to provide this

- Enter the Legal Entity Reference Data.

- Indicate whether you would like to delegate your EMIR reporting to IBKR.

- Select counterparty type and click Continue.

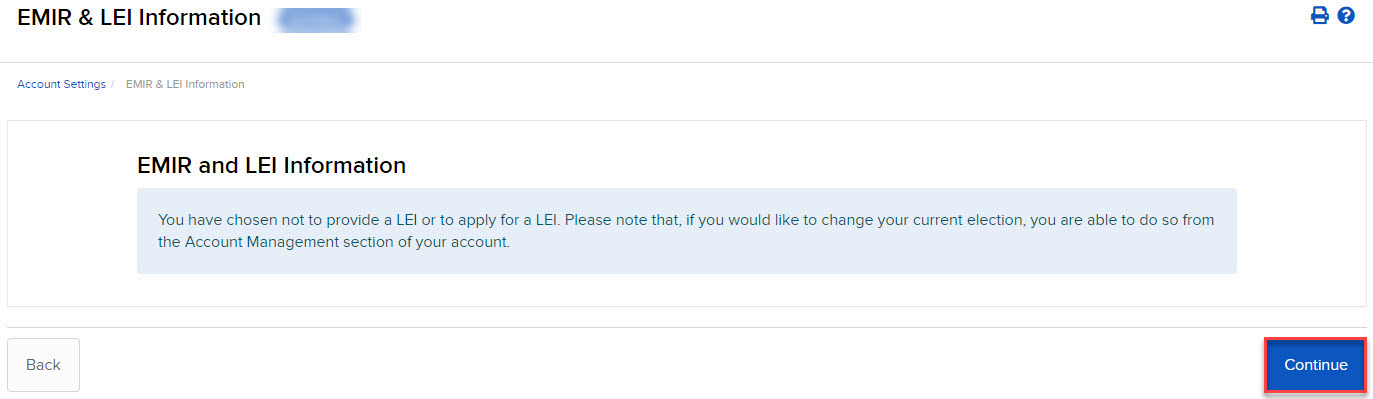

I do not have a LEI and do not want IBKR to apply for a LEI on my behalf as the account holder is not subject to EMIR

- Click Continue to confirm that you have chosen not to provide LEI or to apply for LEI.

I do not have a LEI but would like a third party provider to apply for a LEI

A LEI can also be requested directly from authorised issuing organisations. You can find a list of example providers at the following link: Get a LEI: Find LEI Issuing Organizations

Please note that we are unable to assist with applications submitted through external providers.

FAQ

Who needs to apply for a LEI?

All participants in the financial market who are subject to the reporting obligation must obtain a Legal Entity Identifier (LEI). This includes all independent legal entities, such as corporations, partnerships, and foundations.

Private individuals and legally dependent branches or divisions of companies are not required to obtain a LEI.

What customers will not be eligible to report through IB?

The following types of accounts are not eligible to report through Interactive Brokers, either because they are not subject to the reporting requirements or due to their account structure:

- Individual and joint accounts (not subject to reporting under EMIR)

- Execution-only clients

- Advisor master accounts

- Referring brokers (Referrers)

- Money Managers and Wealth Managers

- SIPP Administrators

- Employee Track master accounts

- Fund Administrator accounts

How does the application for a LEI work and what are the costs?

You can apply for a Legal Entity Identifier (LEI) either through our service partner Interactive Brokers (IB) or via an external LEI issuing organisation.

Fees apply when requesting a LEI through IB. The exact amount of the fees can be found in the pricing schedule of your local branch´s

List of Prices and Services.

What happens if you do not provide a LEI?

Without a Legal Entity Identifier (LEI), LYNX will no longer be able to execute securities transactions that are subject to reporting requirements on behalf of its corporate clients.

Where can I get more information about the LEI?

General information about the Legal Entity Identifier (LEI) is available on the websites of the LEI Regulatory Oversight Committee (LEI ROC) at LEI ROC (www.leiroc.org) and the Global Legal Entity Identifier Foundation (GLEIF) at GLEIF (www.gleif.org).

Where can I find more information on EMIR Reporting?

You can find more information on EMIR Reporting on the following page: EMIR Reporting.