Irish Withholding Tax

As a LYNX client, your account is held with Interactive Brokers (IBKR), which operates under Irish jurisdiction for certain account structures. Because of this relationship, some clients may be subject to Irish tax regulations.

The Irish Revenue Service requires Interactive Brokers (IBKR) to withhold tax on interest earned in Ireland. The standard rate is 20%, deducted from interest payments on your account. This rate may be reduced or exempted if your country of tax residence has a Double Taxation Treaty (DTA) with Ireland.

This information explains when the tax applies, who is affected, and how clients can verify or adjust their tax status.The Irish Revenue Service requires Interactive Brokers (IBKR) to collect withholding tax on interest earned in Ireland. This deduction is at a rate of 20% and should be deducted from the interest payments on your account. This tax can be reduced or abolished if your tax residence has a double taxation treaty (DTA) with Ireland.

What is Irish Withholding Tax?

For retail customers in the EU (excluding Ireland), or for clients who are non-residents of Ireland but tax residents of a country with a Double Taxation Treaty (DTA) with Ireland, Form 8-3-6 is generally required. The form should include your details and be completed by the tax authorities in your country of residence.

Please note that the withholding tax rate depends on the DTA between Ireland and your country of tax residence. These rates are published on the Irish Revenue Service website:

https://www.revenue.ie/en/tax-professionals/tax-agreements/rates/index.aspx

The withholding tax does not apply to corporate brokerage accounts if they are located in member states of the European Union (excluding Ireland) or companies in countries that have a double taxation treaty (DTA) with Ireland.

Form 8-3-6

You must complete the Form 8-3-6 with the following information:

- Name

- Address

- Tax reference number of the country where you live

- The country where you are tax resident

- The applicable withholding tax rate under the treaty with Ireland (see below)

- Signature

- Date

- Capacity of Signatory: fill in Account Holder

Send the Form 8-3-6

After completing the form, it should be physically sent to your local tax office for validation.

Signed and stamped

Once you have received the completed form or a residency statement from your tax authority, you can upload a PDF or JPEG copy of the fully signed form (and residency statement if applicable) in the Client Portal. Click on the bell icon in the top right corner and select ‘Ireland Interest Tax Form 8-3-6 for XXXX’.

Countries in the European Economic Area (EEA) with 0% withholding tax

Countries in the EEA with more than 0% withholding tax

Other countries with Irish double taxation agreement

(countries marked with an asterisk* have a 0% tax rate in all cases)

If you are resident outside the EEA, please use the form specific to non-EEA residents. If your withholding tax rate is 0%, please use the designated 0% form.

If your country of residence is not listed, please contact us at info@lynx.nl

LYNX is not responsible for creating or maintaining this process and has no legal obligation regarding the information provided. LYNX only relays requirements set by Interactive Brokers (IB). The information shown here is derived from the IB webpage and translated by LYNX. In case of discrepancies, the English version prevails. Information is subject to change at any time, and LYNX has no influence on these changes.

FAQ

What interest income is subject to Irish Withholding Tax?

Irish Withholding Tax applies to credit interest received on uninvested cash balances and on short credit interest where you have borrowed shares through IBIE.

It does not apply to interest received under the Stock Yield Enhancement Program or to interest from bond payments.

In what currency is the Irish Withholding Tax charged?

It is charged in the same currency in which you receive credit interest. You can also view details in your Transaction History or a full Activity Statement.

Where can I find the withheld Irish Withholding Tax?

You can find the Irish Withholding Tax withheld under Cash Movements within LYNX+. This also falls under the Taxes category. You can check the instructions on this page for exactly where to find this. You can also view this in your account statements from the 3rd (working) day of the month, when credit interest is also paid out.

What must joint account holders submit to obtain an exemption/reduction?

Each joint account holder must complete their own documentation. This means each account holder must complete a separate Form 8-3-6 and (if relevant) each account holder must provide a separate residency statement.

How long will the completed 8-3-6 form remain valid?

A completed Form 8-3-6 remains valid for 5 years unless there is a change in your circumstances. This is true even if you provided IBIE with a certificate of residence instead of having your Form 8-3-6 stamped by the IRS. So you only need to resubmit this document every 5 years. If there is a material change in your circumstances from a tax perspective, you must notify IBIE immediately and submit an updated Form 8-3-6.

For example, if you move your tax residency from one country to another, you must notify IBIE and provide IBIE with a Form 8-3-6 signed by the new local tax authority.

My tax authority does not want to stamp and sign my Form 8-3-6. Can I file a residency statement instead?

If your tax authority does not stamp the form, you may submit a residency statement instead, together with a completed Form 8-3-6. The Irish Revenue has accepted this option since January 2023.

The residency statement must explicitly confirm that you are tax resident in your country in accordance with the relevant provision of the double taxation treaty between Ireland and that country.

Can I reclaim Irish Withholding Tax that was deducted?

Yes, if you are not subject to Irish Withholding Tax, or are subject to a reduced rate under a double tax treaty between Ireland and your country of residence, you are entitled to a refund of withholding tax paid in excess of the rate set out in the Double Taxation Treaty (DTT).

If you want to reclaim withheld tax, please follow the instructions below:

- If you are eligible to reclaim tax in the previous year, you will have received the R185 Form at the end of January in the current year. You can find it in the Client Portal > Performance & Reports > Statements > Tax Forms section and it should also be sent to you via e-mail. Download this form and save it somewhere you can access it later.

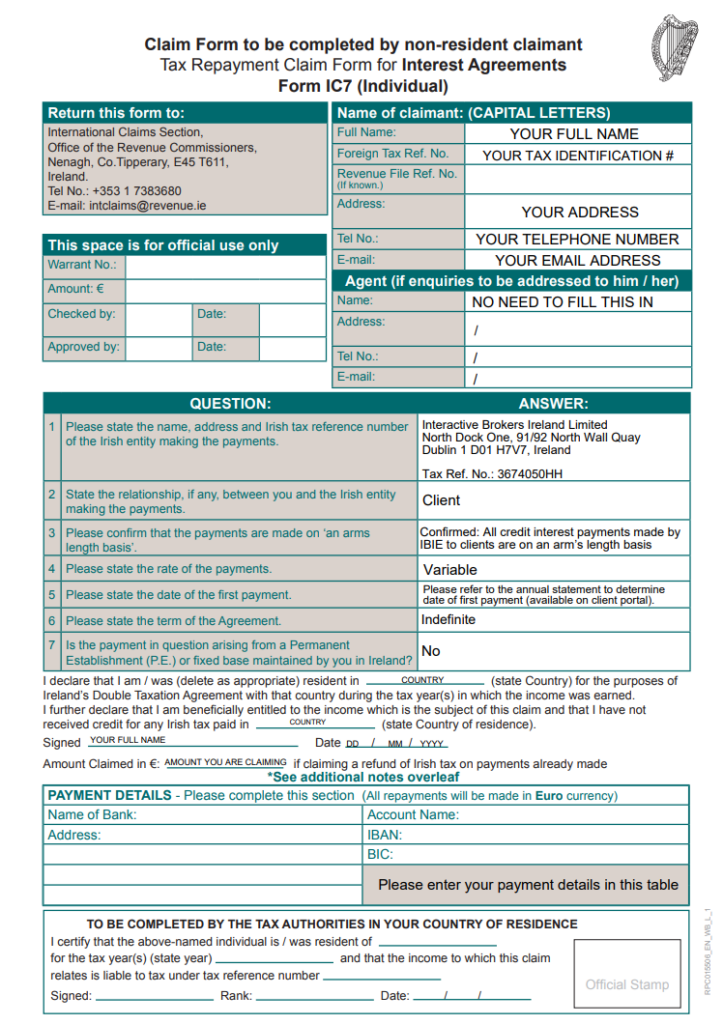

- After this, download and fill in the Form IC7. You can find the form at this link: Form IC7- Claim Form to be completed by non-resident claimant (revenue.ie). Please fill in the form according to the instructions in the sample form that was provided below:

Note: If your tax authority will not stamp the form, the Irish Revenue may accept a certificate of tax residence, which can be attached instead of having that section completed.

- After completing this, post the following to International Claims Section, Office of the Revenue Commissioners, Nenagh, Co Tipperary, E45 T611, Ireland or e-mail them to intclaims@revenue.ie:

- Form IC7. You can download this here: Form IC7- Claim Form to be completed by non-resident claimant (revenue.ie)

- Form R185. You can find this form in the Client Portal > Performance & Reports > Statements > Tax Forms section

- The IBIE Customer Agreement or link to it in an e-mail: https://www.interactivebrokers.ie/en/accounts/forms-and-disclosures-client-agreements.php

- Your certificate of tax residence (if required)

Frequently Asked Questions

- Why can I not find the Form R185?

If there were no withheld taxes on receivable interest , the R185 Form will not be shown in the Tax Forms section of the Statements menu in the Client Portal.

- What is the Time Limit for reclaiming the IWHT?

Claims may only be made within 4 years following the end of the calendar year in which the tax was deducted.

- How will Repayments be made?

All repayments will be made electronically to a specified Bank Account as mentioned in the section Payment Details in the IC7 Form.

- How do I know what amount I can reclaim?

The amount of Tax Withheld will be calculated in the R185 Form, that you can find in the Tax section of the Statements menu. All the withheld taxes eligible for reclaim will be shown in the base currency.

For example, if you are eligible to reclaim withheld taxes on USD interests, the reclaimable amount will be shown in EUR (base currency).

If there were no withheld taxes on receivable interest, the R185 Form will not be shown in the Tax Forms section.